A Quote by Brooksley Born

I think we will have continuing danger from these markets and that we will have repeats of the financial crisis - [they] may differ in details but there will be significant financial downturns and disasters attributed to this regulatory gap, over and over, until we learn from experience

Related Quotes

Financial markets are supposed to swing like a pendulum: They may fluctuate wildly in response to exogenous shocks, but eventually they are supposed to come to rest at an equilibrium point and that point is supposed to be the same irrespective of the interim fluctuations. Instead, as I told Congress, financial markets behaved more like a wrecking ball, swinging from country to country and knocking over the weaker ones. It is difficult to escape the conclusion that the international financial system itself constituted the main ingredient in the meltdown process.

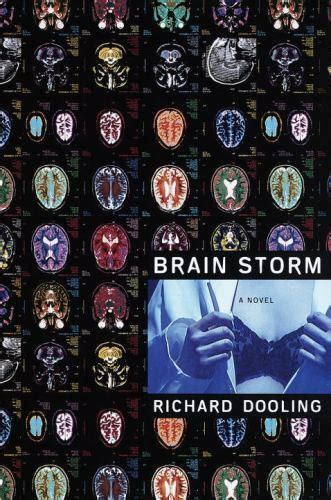

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

I believe that the financial crisis of 2008/9 exposed more a lack of ethics and morality - especially by the financial sector - rather than a problem of regulation or criminality. There were, of course, regulatory lessons to be learned, but at heart, there was a collective loss of our moral compass.

I think that will only really change when the human races begins to suffer some of the extremely severe consequences of climate change which may be some decades ahead. They will then realise, as we have with the financial crisis, that we are up against the wall and hitting the buffers and we have got to change.

Over and over again, financial experts and wonkish talking heads endeavor to explain these mysterious, 'toxic' financial instruments to us lay folk. Over and over, they ignobly fail, because we all know that no one understands credit default obligations and derivatives, except perhaps Mr. Buffett and the computers who created them.