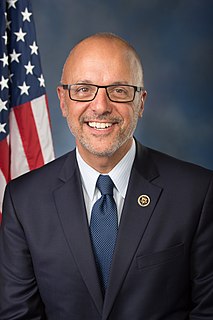

A Quote by Bruce Braley

Increasing the minimum wagewill put billions annually into the Social Security trust fund.

Quote Topics

Related Quotes

The conversation should've been about middle class people. The conversation should've been about how to raise the minimum wage and strengthen Social Security. But then we started talking about this whole email stuff again. And now the outcome is that, you know, Donald Trump has somebody who he's looking at to put on his Cabinet who's a lobbyist to privatize Social Security.

Lets all be reminded, 60 million Americans are on Social Security, 60 million. A third of those people depend on 90% of their income from Social Security. Nobody in this country is on Social Security because they made the decision when they were starting work at 14 that they wanted to trust some of their money with the government.

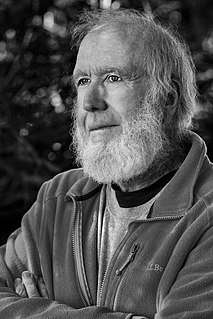

Extrapolated, technology wants what life wants:

Increasing efficiency

Increasing opportunity

Increasing emergence

Increasing complexity

Increasing diversity

Increasing specialization

Increasing ubiquity

Increasing freedom

Increasing mutualism

Increasing beauty

Increasing sentience

Increasing structure

Increasing evolvability