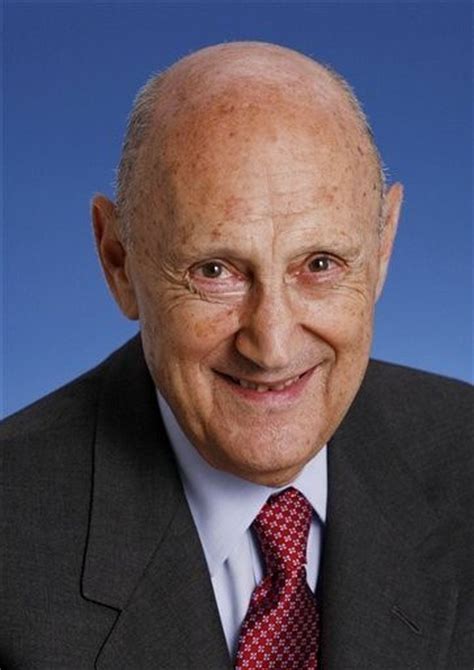

A Quote by Burton Malkiel

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

Related Quotes

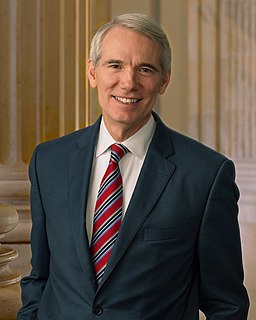

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

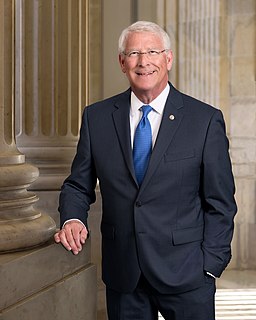

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.