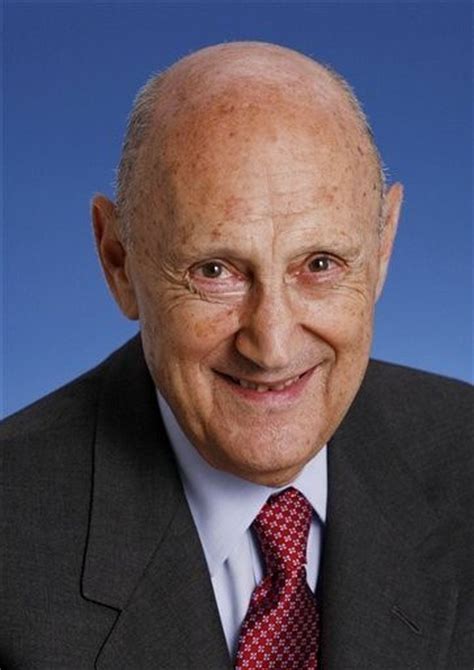

A Quote by Burton Malkiel

Many of us economists who believe in efficiency do so because we view markets as amazingly successful devices for reflecting new information rapidly and, for the most part, accurately.

Related Quotes

The generally accepted view is that markets are always right -- that is, market prices tend to discount future developments accurately even when it is unclear what those developments are. I start with the opposite view. I believe the market prices are always wrong in the sense that they present a biased view of the future.

I think on the efficiency level, not only the distribution level, capitalism is a flawed system. It probably has the same virtues as Churchill attributed to democracy: It's the worst system except for any other. And I think that's right, but it cannot be thought that some unmitigated belief in free markets is a cure even from the efficiency point of view.

The information diet of a senior campaign staffer is insane. We were all addicted to our chosen email delivery devices and were aggressively tethered to them. It made sense and wasn't an issue during the campaign because of the importance of the situation. However, once the campaign was over and we were successful, the information flow dried up.