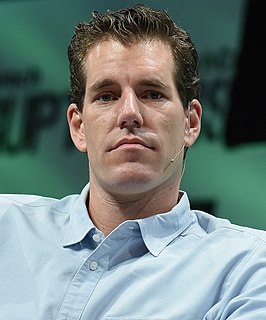

A Quote by Cameron Winklevoss

Bitcoin is both disruptive from a technology perspective, but there's a tremendous power of social good behind it. So you can both build a cool business or have a great investment return, and there's the promise of potentially improving the remittance industry or banking the unbanked.

Related Quotes

A new product, technology, or innovation - such as Bitcoin - has the potential to give rise both to frauds and high-risk investment opportunities. Potential investors can be easily enticed with the promise of high returns in a new investment space and also may be less skeptical when assessing something novel, new, and cutting-edge.

IBM has had a long partnership with Siebel, JD Edwards and Peoplesoft, so from a partner perspective, this is a good move by both sides. This agreement reflects the reality of what customers expect for their investment, support and openness. Oracle really needed to do this for Websphere, but it opens up tremendous opportunities for both companies.

As bank customers, we tend to believe that we can have both perfect security for our money, drawing on it whenever we want and never expecting it not to be there, while still earning a regular rate of return. In a true free market, however, there tends to be a tradeoff: you can enjoy a money warehouse or you can hope for a return on your investment. You can't usually have both. The Fed, however, by backing up this fractional-reserve system with a promise of endless bailouts and money creation, attempts to keep the illusion going.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

You could make a good case that the history of social life is about the history of the technology of memory. That social order and control, structure of governance, social cohesion in states or organizations larger than face-to-face society depends on the nature of the technology of memory - both how it works and what it remembers. In short, what societies value is what they memorize, and how they memorize it, and who has access to its memorized form determines the structure of power that the society represents and acts from.

Another thing I've observed is how critical the role of the CEO is when a technology truly is disruptive. In looking back on companies that have successfully launched independent disruptive business units, the CEO always had a foot in both camps. Never have they succeeded when they spin something off in order to get it off the CEO's agenda. The CEOs that did this had extraordinary personal self-confidence, and almost always they were the founders of the companies.

The personal computer was a disruptive innovation relative to the mainframe because it enabled even a poor fool like me to have a computer and use it, and it was enabled by the development of the micro processor. The micro processor made it so simple to design and build a computer that IB could throw in together in a garage. And so, you have that simplifying technology as a part of every disruptive innovation. It then becomes an innovation when the technology is embedded in a different business model that can take the simplified solution to the market in a cost-effective way.