A Quote by Camille Perri

As our nation's student debt crisis has reached a breaking point, we've been hearing lots of talk about student loan forgiveness. It's taken me 20 years to forgive myself for my loan - and just as long to pay it off.

Related Quotes

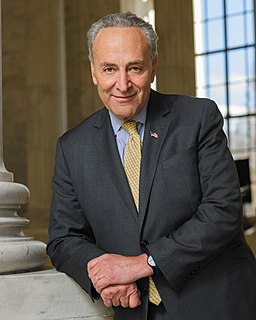

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.