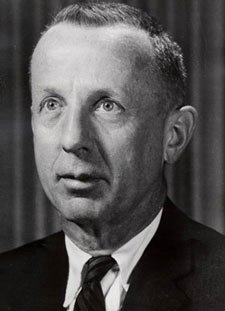

A Quote by Carl Icahn

Yellen’s comments suggest, and I agree, that we are in an asset bubble.

Related Quotes

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.