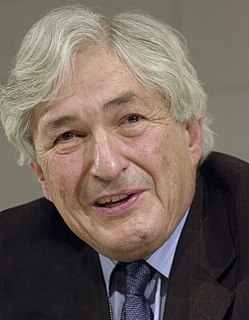

A Quote by Carmen Reinhart

The biggest threat to advanced economies is that debt will accumulate until the overhang weighs on growth.

Related Quotes

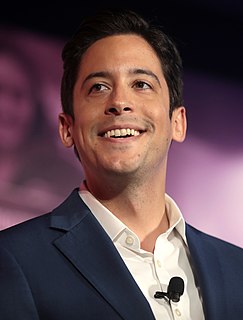

Growing economies are critical; we will never be able to end poverty unless economies are growing. We also need to find ways of growing economies so that the growth creates good jobs, especially for young people, especially for women, especially for the poorest who have been excluded from the economic system.

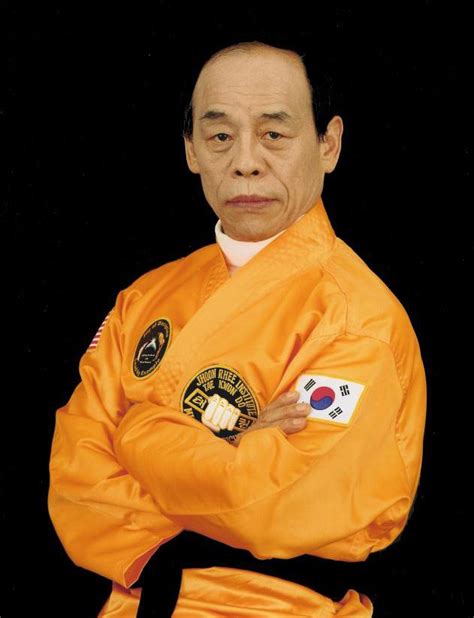

The basic aggregate measure of gearing or leverage is telling us that today's advanced economies' operating systems are more heavily dependent on private sector credit than anything we have ever seen before. Furthermore, this pattern is seen across all the advanced economies, and isn't just a feature of some special subset (e.g. the Anglo-Saxons).