A Quote by Carol Loomis

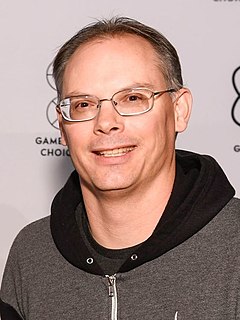

Larry Fink, 61, tall and outgoing and passionate about his business, is the chairman, CEO, and co-founder of the largest asset-management company in the world, BlackRock.

Related Quotes

I think there are probably too many asset management companies in the world, and I think the place to be is either big or small. The area where it is probably more difficult to be is in the middle ground, where you've got that cost of regulation, you've got the cost of buying your own research, you've got all the costs of running an asset management company without the benefits of a big income producing asset.

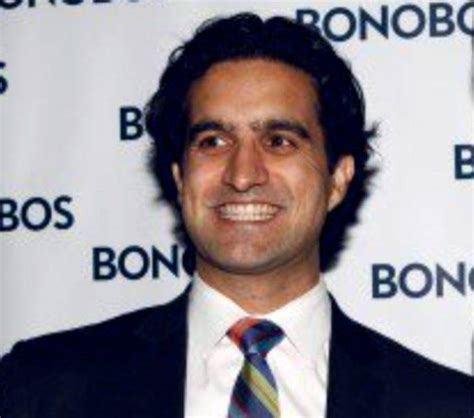

You don't think, when you start a company as the founding CEO, that if your venture actually works, you end up with three jobs: founder, CEO, and chair of the board. The first eight years at Bonobos, I have learned a lot about the tension between the first two. It didn't even occur to me that I had the third job until much later.