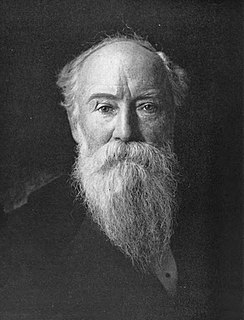

A Quote by Carroll Quigley

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.

Quote Topics

Able

Acting

Agreements

Aim

Arrived

Banks

Capitalism

Central

Central Bank

Central Banks

Concert

Conferences

Control

Controlled

Country

Create

Dominate

Each

Economy

Far

Fashion

Financial

Frequent

Had

Hands

Less

Meetings

Nothing

Political

Political System

Powers

Private

Reaching

Secret

System

Than

Whole

World

Related Quotes

Following World War II, the U.S. was the architect of the UN system, and the world financial system, and the Human Rights Declaration, and of course the United Nations is based here in New York City. But, unfortunately, especially in the last decade, the U.S. really has been turning its back on international agreements and the set of agencies and procedures that they create as a means for governing the world.

In a globally interdependent world, a better financial and investment system cannot be achieved on a country-by-country basis. There may be no one-size-fits-all model for economic development, but without global standards and complementary regulations, the long-term outlook for the world economy will remain bleak.

I see myself, in terms of the question of capitalism, as I would support democratic socialism over a capitalist system, because any approach... or participatory economics, which is another great model that people like Michael Albert are putting out there... any system that encourages us to think about interdependency, and to be able to use the world's resources in a wiser way, for the good of the whole, would be better for the world than capitalism.

This is the first global crisis that doesn't start in poor countries and it was caused by the rich countries. So it's necessary to take advantage of this crisis - the financial system has to be regulated. It's necessary that the central banks in the world should control a little bit the banks' financing, because they cannot bypass a certain range of leverage. And I believe that there's no other - more any reason for a G-8 group or any other "G." I believe that we should guarantee that the G-20 should be now an important forum to discuss the major economic issues of the world.