A Quote by Chamath Palihapitiya

Companies are transcending power now. We are becoming the eminent vehicles for change and influence, and capital structures that matter. If companies shut down, the stock market would collapse.

Related Quotes

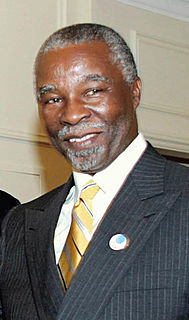

There are black companies that are very active in the economy, that are growing and not on the basis of mergers and acquisitions, but because of putting new money into their particular companies and, therefore, their particular sectors. Indeed, if they didn't do that, they would collapse as companies.

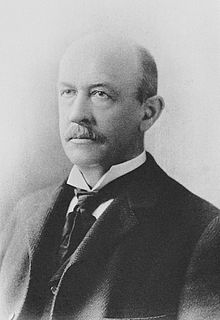

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Tech stocks were the cubic zirconium of the market. They looked good and were sexy, but they just were a way for the company selling them to make money. That's always going to be transient in terms of the stock market. What's real is that companies have to compete. Technology used well is a great tool to enable that if only because most companies dont use technologies well.

People thought they were going to make a lot of money. And then at one point, it got too hot, and the government wanted to knock it down. Trying to get it up and then knock it down, both were a mistake. And part of the reason, some people think, is that they wanted to equitize some of their companies. A healthy stock market helps equitize companies and reduce the country's debt burden.

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity,' sing the praises of companies with high share turnover... but investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pick pocket of enterprise.