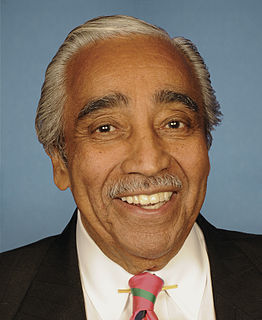

A Quote by Charles B. Rangel

A default on our debts as a result of not meeting our obligations would be a disaster for the stock market, and Americans would see their retirement funds shrivel up.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

It is argued by our GDP obsessed policy planners that eventually the money being made by the stock market operators or the IT industry would trickle down to the poor farmers in terms of ancillary jobs that would be created. But the fact is, that this has not happened, despite the boom in the stock market and the IT industry.

Rip Van Winkle would be the ideal stock market investor: Rip could invest in the market before his nap and when he woke up 20 years later, he'd be happy. He would have been asleep through all the ups and downs in between. But few investors resemble Mr. Van Winkle. The more often an investor counts his money - or looks at the value of his mutual funds in the newspaper - the lower his risk tolerance.

It is up to us, to this present generation of Americans, to take a stand for freedom, to send a message to Washington that we're taking our future back from the grips of central planners who would control our healthcare, who would spend our treasure, who downgrade our future and micro-manage our lives.