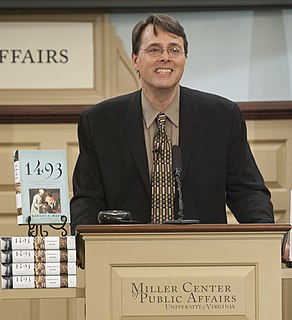

A Quote by Charles C. Mann

Historically, large-scale global trade has served two functions: 1) the exchange of goods between willing sellers and buyers described in Econ 101 textbooks; 2) as a tool of state aggrandizement, in which the private parties are stand-ins for governmental interests.

Related Quotes

80 percent of the export of armament in the world comes from the G8 countries. [The] United States alone exports about 50 percent of the world's armament, [for] which, of course, there has to be buyers, and the buyers are very terribly keen, very often military dictator[s] or sometimes not military dictator[s] but for military purposes. But the sellers are also promoting this trade. And two thirds of the arm exports go to developing countries. I'm in favor of putting a control on it, a ban on it.

I am preoccupied with the possibility of creating art which functions in a public situation without compromising its private character of being antiheroic, antimonumental, antiabstract, and antigeneral. The paradox is intensified by the use on a grand scale of small-scale subjects known from intimate situations--an approach which tends in turn to reduce the scale of the real landscape to imaginary dimensions.