A Quote by Charles Caleb Colton

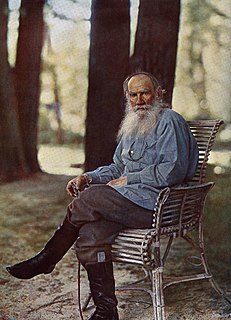

If the prodigal quits life in debt to others, the miser quits it still deeper in debt to himself.

Related Quotes

The U.S. has a law on the books called the debt limit, but the name is misleading. The debt limit started in 1917 for the purpose of facilitating more national debt, not reducing it. It still serves that purpose. It's unconnected to spending, hurts our credit rating and has been an abject failure at limiting debt.

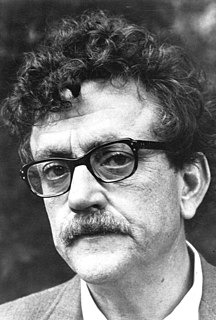

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.