A Quote by Charles Dallara

Our long-term prosperity depends critically on the ability of world leaders to make politically difficult decisions at a time when the global economy is still vulnerable on so many fronts.

Related Quotes

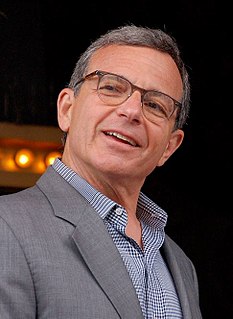

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

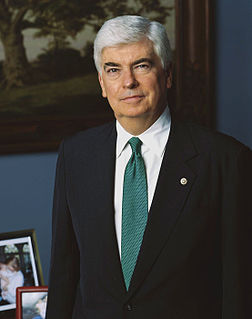

The Bush Administration believes the Kyoto protocol could damage our collective prosperity, and in so doing, actually put our long-term environmental health at risk. Fundamentally, we believe that the protocol both will fail to significantly reduce the long-term risks posed by climate change and, in the short run, will seriously impede our ability to meet our energy needs and economic growth.