A Quote by Charles Dallara

Greece's unprecedented fiscal effort, which was more than planned, has triggered much larger contractions of economic activity and the tax base than the original program had assumed.

Related Quotes

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

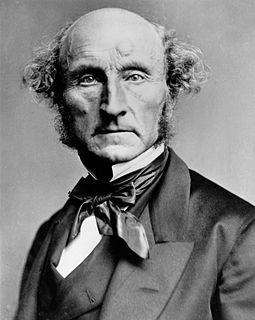

Man is more courageous, pugnacious, and energetic than woman, and has a more inventive genius. His brain is absolutely larger, but whether relatively to the larger size of his body, in comparison with that of woman, has not, I believe been fully ascertained. In woman the face is rounder; the jaws and the base of the skull smaller; the outlines of her body rounder, in parts more prominent; and her pelvis is broader than in man; but this latter character may perhaps be considered rather as a primary than a secondary sexual character. She comes to maturity at an earlier age than man.