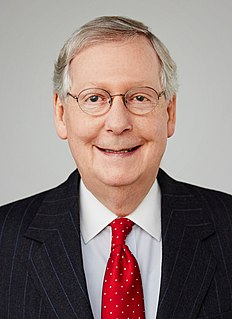

A Quote by Charles Dallara

It was very important for us to hear that both European governments and the IMF are going to sustain and augment their commitment to Greece because they don't pursue the debt reduction route. They're actually extending more debt, more loans to Greece.

Related Quotes

Look at Ukraine. Its currency, the hernia, is plunging. The euro is really in a problem. Greece is problematic as to whether it can pay the IMF, which is threatening not to be part of the troika with the European Central Bank and the European Union making more loans to enable Greece to pay the bondholders and the banks. Britain is having a referendum as to whether to withdraw from the European Union, and it looks more and more like it may do so. So the world's politics are in turmoil.

Greece's European neighbors were able step in and bolster the weak foundation on which Greece's free-spending budget was based. It would be difficult for any country, or intergovernmental organization, to rescue an economy the size of the U.S. if investors were ever to lose faith in our bonds because of our enormous debt.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

Greeks have to know that they are not alone ... Those who are fighting for the survivor of Greece inside the Euro area are deeply harmed by the impression floating around in the Greek public opinion that Greece is a victim. Greece is a member of the EU and the euro. I want Greece to be a constructive member of the Union because the EU is also benefiting from Greece.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Well, as I said, you know the issue of Greek debt, they've grasped the principle of debt reduction. I think most people would argue that probably more needs to be done on that front, and they've just begun to take the first steps to accepting that there's going to have to be much closer economic integration in Europe.

People tend to think that paying a debt is like going out and buying a car, buying more food or buying more clothes. But it really isn't. When you pay a debt to the bank, the banks use this money to lend out to somebody else or to yourself. The interest charges to carry this debt go up and up as debt grows.

You'll have to have the governments sell off all of their public domains; sell off their railroads, sell off their public land. You'll essentially have to introduce neo-feudalism. You'll have to roll the clock of history back a thousand years, and reduce the European population to debt slavery. It's as simple a solution as the Eurozone has imposed on Greece. And it's a solution that the leaders and the banks are urging for responsible economists to promote for the population at large.