A Quote by Charles L. Evans

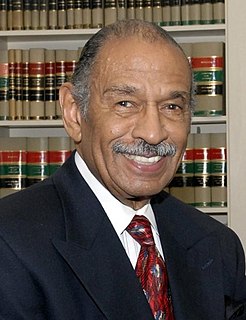

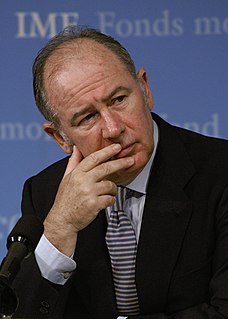

Paul Volcker is a tremendous hero with the Federal Reserve system and for the American economy. He took very tough actions and helped to break the back of double-digit inflation at a time when it had to be done.

Related Quotes

[Australian Reserve Bank] Governor MacFarlane said recently when Paul Volcker broke the back of American inflation it's regarded as the policy triumph of the Western world. When I broke the back of Australian inflation they say, "Oh, you're the fellow that put the interest rates up." Am I not the same fellow that gave them the 15 years of good growth and high wealth that came from it?

Hyperinflation is not going to happen in this country, will never happen... The Fed putting so much money into the system is not going to create the risk of hyperinflation in the future. We have a strong independent Federal Reserve with a very strong mandate from the Congress, and they will do what's necessary to keep inflation low and stable over time.