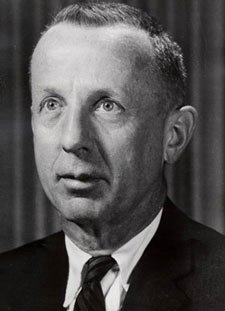

A Quote by Charles P. Kindleberger

The propensity to swindle grows parallel with the propensity to speculate during a boom the implosion of an asset price bubble always leads to the discovery of frauds and swindles

Related Quotes

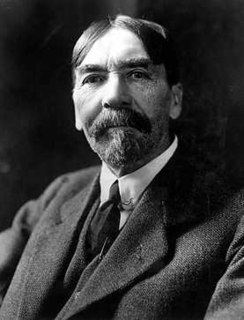

Keynesian modelling relies on marginal propensity to consume and marginal propensity to invest. The idea that if we give more money to the poor, they have a propensity to consume that's much higher than the wealthy, though I wish they would talk to my wife about that; she seems to have a propensity to consume.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.

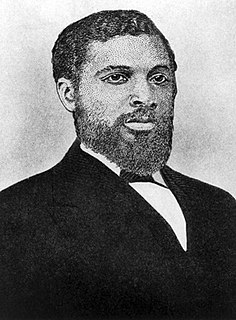

With the exception of the instinct of self-preservation, the propensity for emulation is probably the strongest and most alert and persistent of the economic motives proper. In an industrial community this propensity for emulation expresses itself in pecuniary emulation; and this, so far as regards the Western civilized communities of the present, is virtually equivalent to saying that it expresses itself in some form of conspicuous waste.

We never fought for the popular vote. There was no economical reason, and there was no reason based off the system of our Constitution to do so. We needed to win 270, and to do so we needed to win in certain states, and we needed to target registered voters that had a low propensity to vote and propensity to vote for Donald Trump if they come.

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.