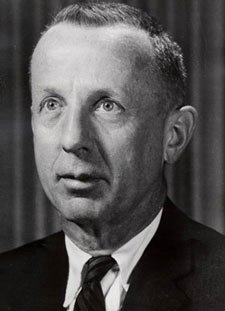

A Quote by Charles P. Kindleberger

The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revivial, but finally giving up in the final collapse.

Related Quotes

A major boom in real stock prices in the US after Black Tuesday brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.

I've always believed that a speculative bubble need not lead to a recession, as long as interest rates are cut quickly enough to stimulate alternative investments. But I had to face the fact that speculative bubbles usually are followed by recessions. My excuse has been that this was because the policy makers moved too slowly - that central banks were typically too slow to cut interest rates in the face of a burst bubble, giving the downturn time to build up a lot of momentum.