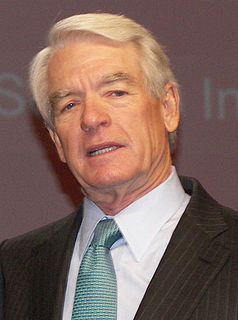

A Quote by Charles R. Schwab

The word passive does a disservice to investors considering their options. Indexing provides an effective means of owning the market and allows investors to participate in the returns of a basket of stocks. The basket of stocks changes over time as stocks are added or removed based on its rules.

Related Quotes

While I take no pleasure in others' misfortunes, we've historically made most of our profits from other investors behaving in a panicked and irrational fashion and selling us certain stocks at prices far below their intrinsic value. More volatility equals cheaper stocks, which equals higher returns.

In the stock market (as in much of life), the beginning of wisdom is admitting your ignorance. One of the many things you cannot know about stocks is exactly when they will up or go down. Over the long term, stocks generally rise at a nice pace. History shows they double in value every seven years or so. But in the short term, stocks are just plain wild. Over periods of days, weeks and months, no one has any idea what they will do. Still, nearly all investors think they are smart enough to divine such short-term movements. This hubris frequently gets them into trouble.

'Ick investing' means taking a special analytical interest in stocks that inspire a first reaction of 'ick.' I tend to become interested in stocks that by their very names or circumstances inspire unwillingness - and an 'ick' accompanied by a wrinkle of the nose on the part of most investors to delve any further.

The enthusiasm for Tesla and other bubble-basket stocks is reminiscent of the March 2000 dot-com bubble. As was the case then, the bulls rejected conventional valuation methods for a handful of stocks that seemingly could only go up. While we don't know exactly when the bubble will pop, it eventually will.

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.