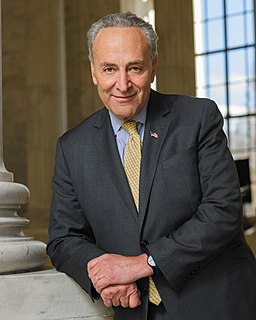

A Quote by Charles Schumer

When Mitt Romney says he wants to reform the tax code, hold on to your wallets.

Related Quotes

We pursued the wrong policies. George Bush is not on the ballot. Bill Clinton is not on the ballot. Mitt Romney is on the ballot, and Barack Obama is on the ballot. And Mitt Romney is proposing tax reform, regulatory reform, a wise budget strategy and trade. The president has proposed tax increases.

Nobody cares that Mitt Romney is rich. It’s Romney’s inability to understand the institutional advantage that he gains from the government’s tax code largesse that’s a little offensive to people. Especially considering Romney’s view on anyone else who looks to the government for things like, I don’t know, food and medicine.

Mitt Romney was treated very unfairly. Mitt Romney didn't want to give his tax returns, because people don't understand returns that are complicated, and complex. And he didn't give it. He fought it, fought it, fought it, all the way into September. A month before the election, he gave his tax returns. And they picked out two items that were absolutely perfect. He did nothing wrong. And his returns are very much smaller than my returns.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.