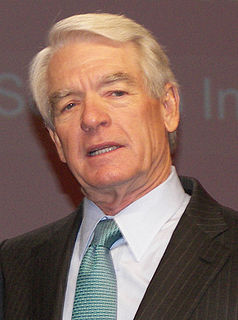

A Quote by Charles Schwab

I frankly think we in the financial service world believe we need appropriate kinds of regulations. No question about that. But when something like Dodd-Frank has been created, sort of in the mystery of night, it is a huge document. It's vast. It weighs about 10 pounds when I carry it around.

Related Quotes

I'm certainly not 10 pounds away from being an ingenue! Of course I would love to lose 10 pounds. I would never lie and say I don't think about it, but I don't think about it on a daily basis. I love my body. I don't like wearing clothes that hide or cover it. I love wearing costumes that show it off.

Dodd-Frank greatly expanded the regulatory reach of the Federal Reserve. It did not, however, examine whether it was correctly structured to account for these new and expansive powers. Therefore, the Committee will be examining the appropriateness of the Fed's current structure in a post Dodd-Frank world.

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.

The only way that you can keep moving forward, finding other ways of expressing things about this increasingly complicated world that we live in, is by listening and observing not only to life around you but to the other people who are in the room. It's not about a sort of, you know, a sense that you have to be democratic about these things, it's a question of creativity that the process of making theatre is a collaborative process, and it is not in, it is not a question of, you know, I have no interest in paying lip service to it, for me it's absolutely fundamental.

I think that the British government has long been on the record saying global warming is a very serious issue and we need to do something about it. I think what they did was they took their own economic experts and they said, "This time, let's try to put together a document that will really convince the rest of the world of a position that we've been holding for a while."