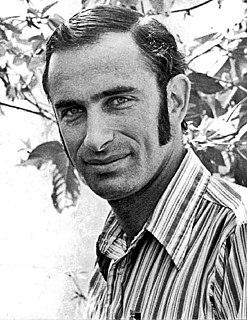

A Quote by Charlie Baker

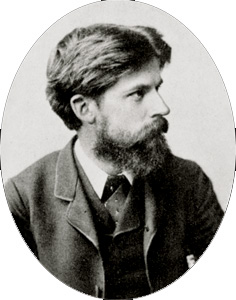

Related Quotes

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

The Bush administration, they had two blue ribbon commissions about infrastructure finance that recommended a lot more money, and additionally the gas tax being increased. We couldn't get them to accept being able to move forward. Since President Obama's been in office, there has been, to be charitable, a lack of enthusiasm for raising the gas tax.

You take the huge income that comes with a big gas tax, and you use it to pay off regressive taxes like the FICA [Federal Insurance Contributions Act] tax. You can help the poor in other ways besides giving them cheap gas. You want to send the message that people want to be as efficient as possible using gasoline until we can transition away from that need entirely.