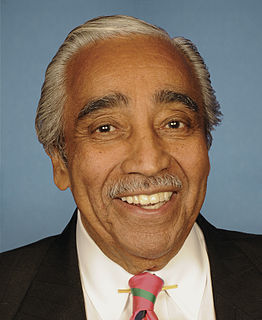

A Quote by Charlie Kirk

When students have access to low-interest loans and government aid, colleges have no incentive to cut costs. Why should a college lower tuition if more students are able to pay with subsidized loans from the government?

Related Quotes

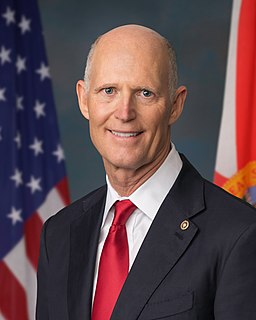

In Germany, college tuition is free. In America, college tuition is increasingly unaffordable. In a highly competitive global economy, which country do you think will have the best educated work force and a competitive advantage? We must make tuition free in public colleges and universities and substantially reduce interest rates on student loans.

Colleges prefer to enroll wealthy students because they know it's more likely that they'll pay for full tuition without needing financial aid. They're also more likely to have parents who will donate large sums of money to the school. When the privileged students graduate, they're expected to join the alumni association and also donate cash.

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

Imagine you have six loans, small to huge. People want to close loans and because of that, they try to pay off the small loans, but that's not the right strategy. The right strategy, of course, is to pay the loan with the highest interest rate. People make this mistake and it costs them lots and lots of money, it's a very expensive mistake because interest rates accumulate and become very, very expensive very quickly.