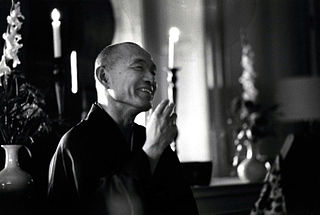

A Quote by Charlie Munger

Investing is where you find a few great companies and then sit on your ass.

Related Quotes

One of the best investors around, Joel Greenblatt, has written a popular, charming and funny book about investing in great companies at low P/E multiples. To simplify an already simple book, great companies are generally measured as companies that can generate lots of profit without requiring a lot of capital. This means that they have high ROEs.

I can't be paralyzed anymore by the critics. My new mantra is, if you're not in the arena getting your ass kicked on occasion, then I'm not interested in your feedback. You don't get to sit in the cheat seat and criticize my appearance or my work with mean-spiritedness if you're also not in the arena.

Sit down at ten o'clock in the morning and write anything that comes into my head until twelve. One of the few things I've discovered about writing is to form a habit that becomes an addiction so that if you don't put something down on paper every day, you get really mean and awful with withdrawal symptoms, and your wife and your dog and your kids are going to kick your ass until you get back to it because they can't bear you in that state of mind.

There is a natural tendency for investors to devote a significant majority of their time to finding new ideas. After all, uncovering great companies selling at great prices is the lifeblood of successful investing. But in the never-ending quest for the next great idea, investors often give short shrift to their existing investments.