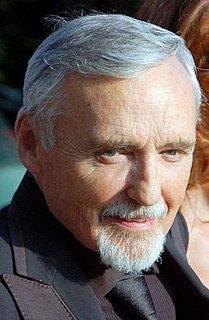

A Quote by Charlie Munger

The big money is not in the buying and selling ... but in the waiting.

Related Quotes

With a profession such as investing, people see the 'doing' as the buying and selling. It is difficult to come home from work, and answer your spouse's question, 'what did you do today?' with 'well, I read a lot, and I talked a little.' If you're not buying or selling, you may feel you aren't doing anything.

Here are white men poised to run big marijuana businesses, dreaming of cashing in big—big money, big businesses selling weed—after 40 years of impoverished black kids getting prison time for selling weed, and their families and futures destroyed. Now, white men are planning to get rich doing precisely the same thing?

There's only one thing that all of the central banks control and that is the base, their own liability, and they can control that in various ways. They can control it directly by open market operations, buying and selling government securities or other assets, for example, buying and selling gold, or they can control it indirectly by altering the rate at which banks lend to one another.

Network marketing is based purely on relationship selling, which is the state of the art in selling today. Small and large companies throughout the country and the world are realizing that individuals selling to their friends and associates is the future of sales, because the critical element in buying is trust.

We think of prices as simply the notation of how much we must pay for things. But the price system accomplishes far more than that. Hundreds of millions of people buying and selling, and abstaining from buying and selling, generate a system of signals - prices to producers and consumers about relative scarcities and demand. Through this system, consumers can convey to producers their subjective priorities and entrepreneurs can invest accordingly.