A Quote by Charlie Munger

You must value the business in order to value the stock.

Related Quotes

In essence, the stock market represents three separate categories of business. They are, adjusted for inflation, those with shrinking intrinsic value, those with approximately stable intrinsic value, and those with steadily growing intrinsic value. The preference, always, would be to buy a long-term franchise at a substantial discount from growing intrinsic value.

Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life. The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure, and it is additionally an estimate that must be changed if interest rates move or forecasts of future cash flows are revised.

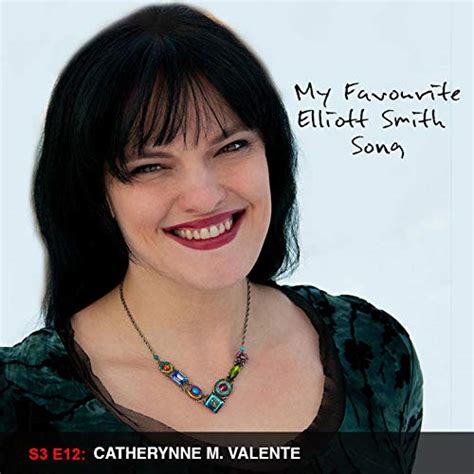

I am a Prince," he replied, being rather dense. "It is the function of a Prince—value A—to kill monsters—value B—for the purpose of establishing order—value C—and maintaining a steady supply of maidens—value D. If one inserts the derivative of value A (Prince) into the equation y equals BC plus CD squared, and sets it equal to zero, giving the apex of the parabola, namely, the point of intersection between A (Prince) and B (Monster), one determines value E—a stable kingdom. It is all very complicated, and if you have a chart handy I can graph it for you.

In Kentucky, we're destroying mountains, including their soils and forests, in order to get at the coal. In other words, we're destroying a permanent value in order to get at an almost inconceivably transient value. That coal has a value only if and when it is burnt. And after it is burnt, it is a pollutant and a waste-a burden.

[W]e think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value -- in the hope that it can soon be sold for a still-higher price -- should be labeled speculation (which is neither illegal, immoral nor -- in our view -- financially fattening).

One of the evils of paper money is that it turns the whole country into stock jobbers. The precariousness of its value and the uncertainty of its fate continually operate, night and day, to produce this destructive effect. Having no real value in itself it depends for support upon accident, caprice, and party; and as it is the interest of some to depreciate and of others to raise its value, there is a continual invention going on that destroys the morals of the country.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.