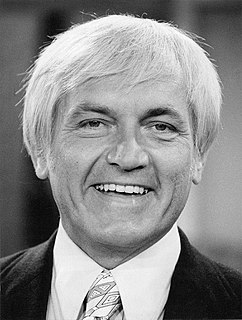

A Quote by Charlie Munger

The possibility that stock value in aggregate can become irrationally high is contrary to the hard-form "efficient market" theory that many of you once learned as gospel from your mistaken professors of yore. Your mistaken professors were too much influenced by "rational man" models of human behavior from economics and too little by "foolish man" models from psychology and real-world experience.

Quote Topics

Related Quotes

We wish we could have been there for you. We didn't have many role models of our own--we latched on to the foolish love of Oscar Wilde and the well-versed longing of Walt Whitman because nobody else was there to show us an untortured path. We were going to be your role models. We were going to give you art and music and confidence and shelter and a much better world. Those who survived lived to do this. But we haven't been there for you. We've been here. Watching as you become the role models.

Treatment of the apparently whimsical fluctuations of the stock quotations as truly non stationary processes requires a model of such complexity that its practical value is likely to be limited. An additional complication, not encompassed by most stock market models, arises from the manifestation of the market as a nonzero sum game.

It is obvious that the great majority of humans throughout history have had grossly, even ridiculously, unrealistic concepts of the world. Man is, among many other things, the mistaken animal, the foolish animal. Other species doubtless have much more limited ideas about the world, but what ideas they do have are much less likely to be wrong and are never foolish. White cats do not denigrate black, and dogs do not ask Baal, Jehovah, or other Semitic gods to perform miracles for them.

As one of a handful of religion professors in the U.S. who study, write, and teach about conservative Christianity and politics, I am all too aware of the real meaning of the list and of its purpose. Promoted by Turning Point USA, the list is not simply designed to expose professors who discriminate; it is designed to silence and smear.

Direct experience is inherently too limited to form an adequate foundation either for theory or for application. At the best it produces an atmosphere that is of value in drying and hardening the structure of thought. The greater value of indirect experience lies in its greater variety and extent. History is universal experience, the experience not of another, but of many others under manifold conditions.

Models walking down the street are very rarely recognized as such. It is often the same as it was for me: models were the school freaks. Way too thin and their eyes way too far apart. They were not the ideal. But then they put on fantastic clothes, have their make up done and you have this special beauty. It's a creation.

For the theory-practice iteration to work, the scientist must be, as it were, mentally ambidextrous; fascinated equally on the one hand by possible meanings, theories, and tentative models to be induced from data and the practical reality of the real world, and on the other with the factual implications deducible from tentative theories, models and hypotheses.

By giving professors jobs for life, universities create a feeling of unanswerable power among too many. Tenured professors who are uninterested in serving the student body are less likely to respond favorably to criticism, and are more likely to feel the freedom to intimidate or harass those with opposing viewpoints.