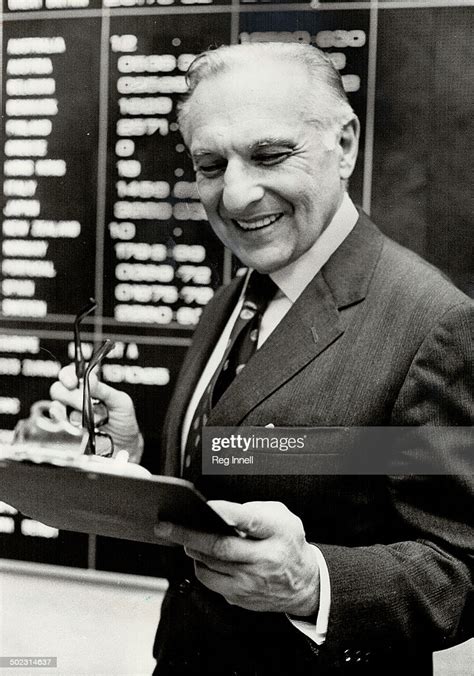

A Quote by Charlie Munger

I think democracies are prone to inflation because politicians will naturally spend [excessively] - they have the power to print money and will use money to get votes. If you look at inflation under the Roman Empire, with absolute rulers, they had much greater inflation, so we don't set the record. It happens over the long-term under any form of government.

Related Quotes

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

Never forget that no government has wealth of its own to spend. The money has to come from taxation, monetary inflation, or debt expansion that must be paid later. And government's spending choices will always be uneconomic relative to how society would use that wealth. That is to say, the money will be wasted.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

Cash - in savings accounts, short-term CDs or money market deposits - is great for an emergency fund. But to fulfill a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.

The time will come, and probably during 2009, that the only way the U.S. will be able to fund its deficits is to create money by printing it. The Treasury will have to sell bonds, and, in the absence of foreign buyers, the Fed will have to print the money to buy them. The consequence will be runaway inflation, increasing interest rates, recession, and inevitable tax increases on all Americans.

It’s hard to build models of inflation that don't lead to a multiverse. It’s not impossible, so I think there’s still certainly research that needs to be done. But most models of inflation do lead to a multiverse, and evidence for inflation will be pushing us in the direction of taking [the idea of a] multiverse seriously.