A Quote by Charlie Munger

Some years ago one oil company bought a fertilizer company, and every other major oil company practically ran out and bought a fertilizer company. And there was no more damned reason for all these oil companies to buy fertilizer companies, but they didn't know exactly what to do, and if Exxon was doing it, it was good enough for Mobil and vice versa.

Related Quotes

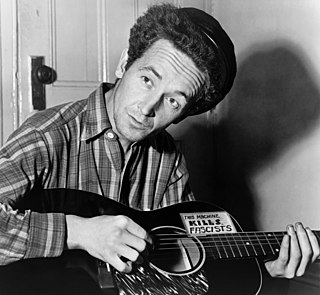

You oil field workers, come and listen to me I'm goin' to tell you a story about old John D. That company union made a fool out of me. That company union don't charge no dues It leaves you a-singing them Rockefeller blues. That company union made a fool out of me. Takes that good ole C.I.O., boys To keep that oil a-rollin', rollin' over the sea. Takes that good ole C.I.O., boys To keep that oil a-rollin' over the sea.

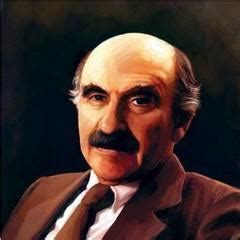

Speaking about our largest oil company Rosneft, and I recalled in the beginning that almost 20 percent of it [19.7] belongs to BP. Who's company is that? British Petroleum, isn't it? I suppose that is not bad. I have to tell that British Petroleum's capitalization is significantly related to the fact that it owns more than 19 percent of Rosneft, which has vast oil reserves both in Russia and abroad. This has its impact on the company's stability as well.

The oil industry is a stunning example of how science, technology, and mass production can divert an entire group of companies from their main task. ... No oil company gets as excited about the customers in its own backyard as about the oil in the Sahara Desert. ... But the truth is, it seems to me, that the industry begins with the needs of the customer for its products. From that primal position its definition moves steadily back stream to areas of progressively lesser importance until it finally comes to rest at the search for oil.

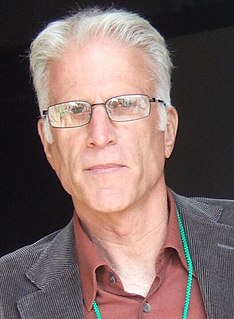

There are companies that are good at improving what they're already doing. There are companies that are good at extending what they're doing. And finally there are companies that are good at innovation. Every large company has to be able to do all three - improve, extend, and innovate - simultaneously.

Now, if the Standard Oil Company were the only concern in the country guilty of the practices which have given it monopolistic power, this story never would have been written. Were it alone in these methods, public scorn would long ago have made short work of the Standard Oil Company. But it is simply the most conspicuous type of what can be done by these practices. The methods it employs with such acumen, persistency, and secrecy are employed by all sorts of business men, from corner grocers up to bankers. If exposed, they are excused on the ground that this is business.