A Quote by Charlie Munger

We bought a doomed textile mill [Berkshire Hathaway] and a California S&L [Savings & Loan; Wesco] just before a calamity. Both were bought at a discount to liquidation value.

Related Quotes

I’d say that Berkshire Hathaway’s system is adapting to the nature of the investment problem as it really is. We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.

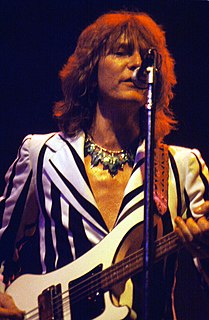

I think the first three Rickenbacker basses were imported around 1964. Pete Quaife, the bassist for The Kinks, bought one. Then John Entwistle from The Who bought one. As for the third one, I asked the manager of the store if I could get an employee discount. He said I could, and so I picked up that one.