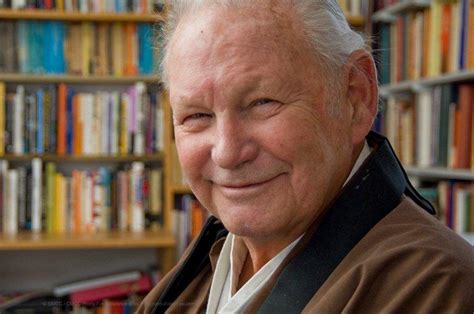

A Quote by Charlie Munger

An investment decision in the common stock of a company frequently involves a whole lot of factors interacting ... the one thing that causes the most trouble is when you combine a bunch of these together, you get this lollapalooza effect.

Related Quotes

The most common mistakes were investing in money market funds by people who were so scared at the prospect of managing their own funds that they picked the most conservative option, and their investments did not keep up with inflation. The second major mistake was being too heavily invested in their own company's stock, and buying when it was high and there was a lot of optimism about the company, and then having to sell it low when the company got in trouble.

The most important thing about an astronaut is you have to take for a given a person's done pretty well in school, has the intelligence and all of that to learn new systems and new things. But after that, the most important thing I think is being able to get along with others. Flexibility and teamwork, those issues because as we fly longer and longer in space, those are really important factors, even on short shuttle missions, those are important factors, to put a crew together that can work together effectively as a team, that can get along.

In a large pharmaceutical company, where it's a big bet, you're going to need finance people to be involved in the decision-making because the investment can run into the hundreds of millions of dollars. You're going to have to run scenarios. You might even need agreement from the C.E.O. to make that type of decision. If it's an incremental, low-cost decision in a marketing-oriented company, it may be a very different set of stakeholders a lot further down in the organization.

Deciding to get back together with someone is a complicated and difficult decision. Just remember that the person you are getting back together with is the same person who, not long before, looked you in your beautiful face, took full stock of you and all your qualities, and told you that he was no longer in need of your company.

A company is a multidimensional system capable of growth, expansion, and self-regulation. It is, therefore, not a thing but a set of interacting forces. Any theory of organization must be capable of reflecting a company's many facets, its dynamism, and its basic orderliness. When company organization is reviewed, or when reorganizing a company, it must be loked upon as a whole, as a total system.