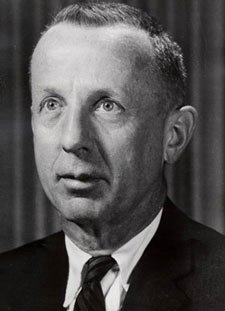

A Quote by Charlie Munger

You have a real asset-price bubble in places like parts of California and the suburbs of Washington, D.C.

Quote Topics

Related Quotes

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.

A lot of the people in Northern California and parts of Oregon have decided that we are not on the same page as San Francisco and Portland and Los Angeles. I don't know if six states is a solution because is Washington, D.C. and the rest of the country really going to give California 10 new senators?

Don't you know that there's another bubble as well An expectations bubble. Bigger houses private planes yachts ...... stupid salaries and bonuses. People come to desire these things and expect them. But the expectations bubble will burst as well as all bubbles do. Come to my gallery and I will sell you beautiful things at a more reasonable price. But the point is that they will have value. Things of real beauty things of the spirit.

When Washington State has been good, they've always had a connection to Southern California. You know, as far as visiting, that's different than recruiting. Recruiting is based on production and players, who you can get. You know, so, the nicest parts of Southern California aren't necessarily the best players.

The state of New Jersey is really two places - terrible cities and wonderful suburbs. I live in the suburbs, the final battleground of the American dream, where people get married and have kids and try to scratch out a happy life for themselves. It's very romantic in that way, but a bit naive. I like to play with that in my work.