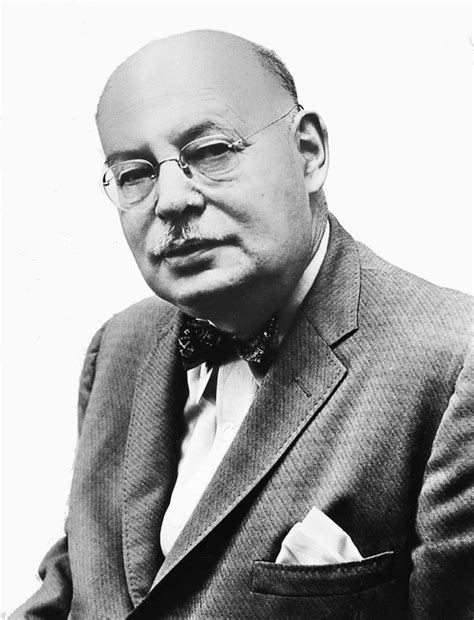

A Quote by Charlie Munger

A banker who is allowed to borrow money at X and loan it out at X plus Y will just go crazy and do too much of it if the civilization doesn't have rules that prevent it.

Related Quotes

There is a strange idea aboard, held by all monetary cranks, that credit is something a banker gives to a man. Credit, on the contrary, is something a man already has. He has it, perhaps, because he already has marketable assets of a greater cash value than the loan for which he is asking. Or he has it because his character and past record have earned it. He brings it into the bank with him. That is why the banker makes him the loan.

The new American dream is one of responsibility. What is the bottom-line number that you're going to be able to pay back toward a student loan responsibly if you're doing it yourself after you have a job? That dictates the amount of money you can borrow. That dictates the school you can go to, if you can even go to a four-year college at all.

Of all the wonderful things government says, that's always been just about my favorite. As opposed to if you get to keep the money. Because what you'll do is go out and bury it in your yard, anything to prevent that money from creating jobs. They never stop saying it.We will say, "This is expected to create x number of jobs." On the other hand, we never say that the money we removed from another part of the economy will kill some jobs.

Because Roman civilization perished through barbarian invasions, we are perhaps too much inclined to think that that is the only way a civilization can die. If the lights that guide us ever go out, they will fade little by little, as if of their own accord.... We therefore should not console ourselves by thinking that the barbarians are still a long way off. Some peoples may let the torch be snatched from their hands, but others stamp it out themselves.