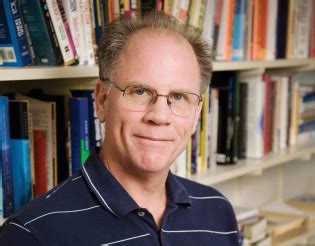

A Quote by Chip Conley

Conventional wisdom suggests the primary motivator for entrepreneurs is money or wealth creation and, in fact, much of the political debate tends to center around what kind of tax or regulatory policy changes will turn corporate suits into small business adventurers overnight.

Related Quotes

Business is a creative and therefore spiritual endeavor. Great entrepreneurs enter the field of business in the same way great artists enter the field of art. With their business creation, entrepreneurs express their spiritual desire for self-realization, evolutionary passion for self- fulfillment, and creative vision of a new world. The entrepreneur's business is their artwork. The creation of business is as creative as any creation in art. In fact, building a business may be the most creative human activity.

Acknowledge the complexity of the world and resist the impression that you easily understand it. People are too quick to accept conventional wisdom, because it sounds basically true and it tends to be reinforced by both their peers and opinion leaders, many of whome have never looked at whether the facts support the received wisdom. It's a basic fact of life that many things "everybody knows" turn out to be wrong.

Cheap labor is a small part of the problem at work here. If it were only cheap labor, America would be in trouble. Because it's other things, too, we have a great chance to turn it around. Here's the problem: Our high corporate tax rate pushes our companies offshore. Our high regulatory burden pushes our companies offshore.

You got to remember, S corporations pay one layer of tax, corporations pay two layers of tax. So we basically see equivalent, but here`s the point. The rest of the world, they tax their businesses at an average rate in the industrialized world of 23 percent. Our corporate is 35. Our top S corporate, small business rate is 44.6 effectively. This is killing us.

In America we're seeing the emergence of Donald Trump, who's the anti-establishment candidate, if you will, who's bucking all the conventional political wisdom on the basis of the fact that so many Americans feel that they've been left behind by the political system and that it's working to entrench advantage by insiders, rather than advantage the people of that country.

President Trump repeatedly says that "America is the highest-taxed country in the world." This is an alternative fact. We pay less in taxes, and our government spends less, as a share of our total wealth, than our counterparts in Western Europe and East Asia. But Trump is right when it comes to corporate tax rates; the U.S. corporate income tax right is among the highest in the world.

Obama wants to take the individual small business tax to 44 percent, and the corporate rate - he says - down to 28 percent or whatever. But that really damages the small businesses. And it doesn't make us competitive. You got to take them both down to 20, because state and local corporate taxes are 5 percent.

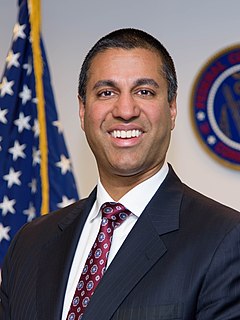

We all agree on the core values of a free and open Internet. We simply may disagree on the appropriate regulatory framework for securing those values. And I would much rather have an open and honest debate about the appropriate regulatory framework as opposed to throwing misinformation out there to achieve political ends.