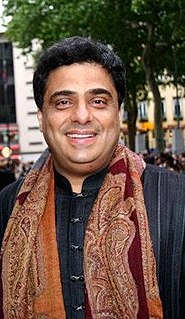

A Quote by Chris Corrigan

I think Virgin Blue is still a very promising and exciting business.

Now, I know that's not a view that's widely held in the market but I think the market is simply throwing it into the too-hard basket at the present time because of the oil price events.

But we think it is still a very exciting business.

Related Quotes

In our view, though, investment students need only two well-taught courses-How to Value a Business, and How to Think about Market Prices. Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business who's earnings are virtually certain to be materially higher five, ten and twenty years from now.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

In the financial markets, however, the connection between a marketable security and the underlying business is not as clear-cut. For investors in a marketable security the gain or loss associated with the various outcomes is not totally inherent in the underlying business; it also depends on the price paid, which is established by the marketplace. The view that risk is dependent on both the nature of investments and on their market price is very different from that described by beta.

The hardest thing over the years has been having the courage to go against the dominant wisdom of the time to have a view that is at variance with the present consensus and bet that view. The hard part is that the investor must measure himself not by his own perceptions of his performance, but by the objective measure of the market. The market has its own reality. In an immediate emotional sense the market is always right so if you take a variant point of view you will always be bombarded for some time by conventional wisdom as expressed by the market.

I don't know whether we think in moving images or whether we think in still images. I have a suspicion that on our hard drive, our series within our brains, [exist] still photographs of very important moments in our lives. ... That we think in terms of still images and that what the photography is doing is making direct contact with the human hard drive and recording for all time a sense of what happened.