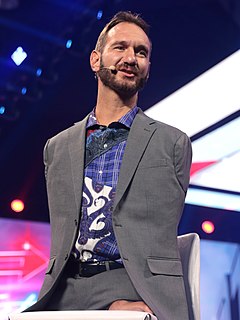

A Quote by Chris Corrigan

I'd always had a childhood ambition to go into the investment capital business, and spent twenty-odd years in it. But the thought of spending the second half of my career in the same business was boring, so I looked around for other opportunities .

Related Quotes

Netflix, Amazon, iTunes - whatever platforms emerge - we are looking at as having the same potential that home video had for the movie business. Which means there are entirely new opportunities to monetize our capital investment in content and do so in ways that work for distributors, for consumers and for creators.

Over the long term, it's hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you're not going to make much different than a six percent return - even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you'll end up with one hell of a result.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

I spent the first twenty years of my running career trying to run as many miles as I could as fast as I could. Then I spent the next twenty years trying to figure out how to run the least amount of miles needed to finish a marathon. And I've come to the conclusion the second way is much more enjoyable.

When you get into this business you have to grow up quickly. But I wouldn't say I've lost any of my childhood, I've always been a mature child. My Mom says I've been like that since I was little kid. I make time for my friends and I make time for things that other kids do. This is a business and I knew what I was getting into. I make time for being a kid, but I also know when to put on my business hat and go for the business.

I saw that we needed to grow but our top line wasn't growing, so we had to find other ways to grow the business. We had to reshape our business and acquire share in a non conventional way. But most tech leaders don't come out of a business background. They really have a parochial point of view. All they know are the go-go years of Silicon Valley. That's the environment in which they were raised.