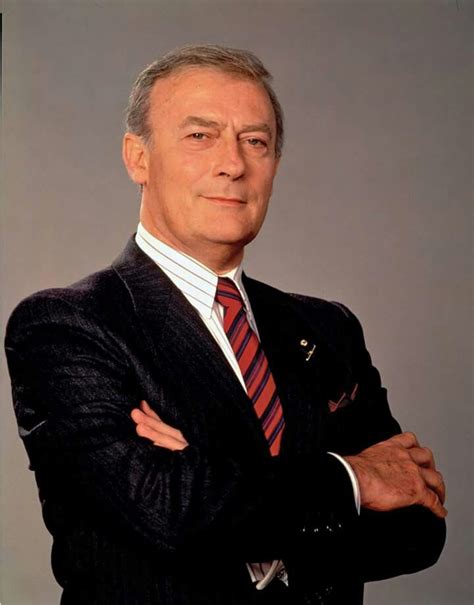

A Quote by Chris de Burgh

I have always had a long term view on records as I want them to be books and not magazines and newspapers that you discard very quickly.

Related Quotes

I grew up in a very British family who had been transplanted to Canada, and my grandmother's house was filled with English books. I was a very early reader, so I was really brought up being surrounded with piles of British books and British newspapers, British magazines. I developed a really great love of England.

Frequent comparative ranking can only reinforce a short-term investment perspective. It is understandably difficult to maintain a long-term view when, faced with the penalties for poor short-term performance, the long-term view may well be from the unemployment line ... Relative-performance-oriented investors really act as speculators. Rather than making sensible judgments about the attractiveness of specific stocks and bonds, they try to guess what others are going to do and then do it first.

You pick up very well-known books on Lincoln [and] you will find almost no reference to his long-term belief in colonization. Why? Because it doesn't fit the image of the Great Emancipator. It doesn't fit the retrospective view we want to have of Lincoln as the man who was the moralist in politics, who came into office committed to ending slavery and waited to sign this document.