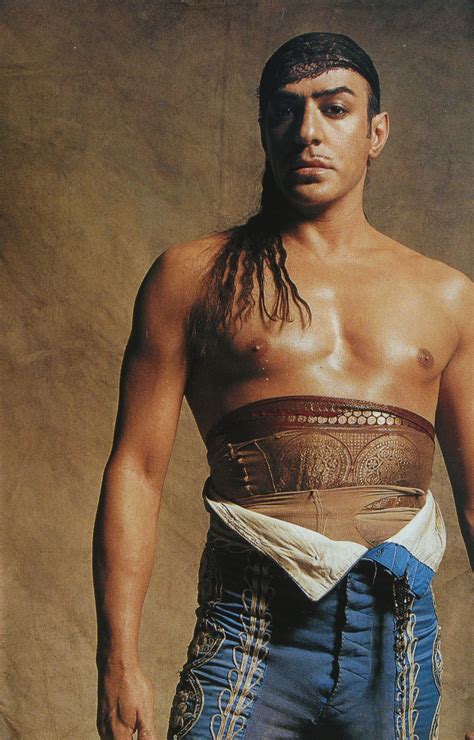

A Quote by Chris Powell

The Debasement of World Currency:It Is Inflation, But Not As We Know It

Related Quotes

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

A strong currency means that American consumers and businesses can buy imported goods and services more cheaply and that inflation and interest rates will be lower, ... It also puts pressure on American industry to increase productivity and competitiveness. These benefits can feed on themselves as foreign capital flows in more readily because of greater confidence in our currency. A weak dollar would have the contrary effects.