A Quote by Christina Romer

Our estimates suggest that a tax increase of 1 percent of GDP reduces output over the next three years by nearly 3 percent. The effect is highly significant.

Related Quotes

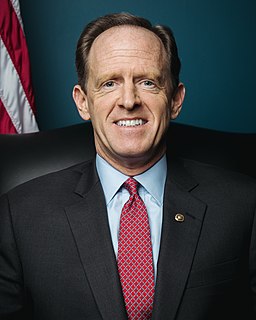

If we had 3 percent growth, which is what we're trying to get to, what we're at, by the way, right now, we're trying to maintain that 3 percent growth. If we had been at 3 percent growth over the last ten years, the budget very nearly would be balanced in 2017. That's how big a difference it makes when you grow the American economy that additional 1 percent over ten years.

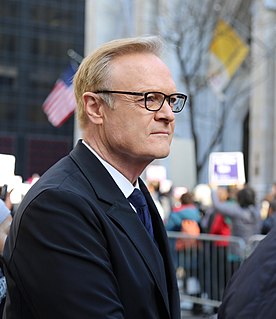

I'm going to create tremendous jobs. And we're bringing GDP from, really, 1 percent, which is what it is now, and if Hillary Clinton got in, it will be less than zero. But we're bringing it from 1 percent up to 4 percent. And I actually think we can go higher than 4 percent. I think you can go to 5 percent or 6 percent.

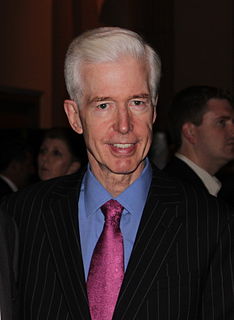

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

Of course, the UK is a significant economy that makes up a quarter of American exports to the EU, more than 50 percent of our exports in certain sectors and over 25 percent of the government procurement opportunities we have in Europe. Brexit reduces the size of the TTIP deal for the United States, and there will need to be an adjustment of expectations accordingly, but Brexit underscores the value of reaching an agreement at this critical moment in the evolution of Europe.

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?