A Quote by Christine Lagarde

If Lehman Brothers had been a bit more Lehman Sisters ... we would not have had the degree of tragedy that we had as a result of what happened.

Related Quotes

I mean there is no capital requirements to it or anything of the sort. And basically, I said there were possibly financial weapons of mass destruction, and they had them. They destroyed AIG. They certainly contributed to the destruction of Bear Sterns and Lehman. Although Lehman had other problems, too.

No one suggested Lehman deserved to be saved. But the argument has been made that the crisis might have been less severe if it had been saved, because Lehman's failure created remarkable uncertainty in the market as investors became confused about the role of the government and whether it was picking winners and losers.

In truth, in the fairy-tale version of bailing out Lehman, the next domino, A.I.G., would have fallen even harder. If the politics of bailing out Lehman were bad, the politics of bailing out A.I.G. would have been worse. And the systemic risk that a failure of A.I.G. posed was orders of magnitude greater than Lehman's collapse.

He was about to go home, about to return to the place where he had had a family. It was in Godric’s Hollow that, but for Voldemort, he would have grown up and spent every school holiday. He could have invited friends to his house. . . . He might even have had brothers and sisters. . . . It would have been his mother who had made his seventeenth birthday cake. The life he had lost had hardly ever seemed so real to him as at this moment, when he knew he was about to see the place where it had been taken from him.

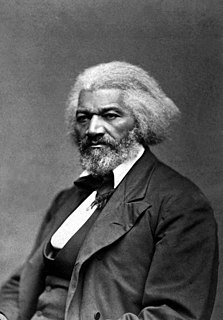

Grandmother pointed out my brother Perry, my sister Sarah, and my sister Eliza, who stood in the group. I had never seen my brother nor my sisters before; and, though I had sometimes heard of them, and felt a curious interest in them, I really did not understand what they were to me, or I to them. We were brothers and sisters, but what of that? Why should they be attached to me, or I to them? Brothers and sisters were by blood; but slavery had made us strangers. I heard the words brother and sisters, and knew they must mean something; but slavery had robbed these terms of their true meaning.

American business would be run better today if there was more alignment between CEOs' interest and the company. For example, would the financial crisis of 2008 have occurred if the CEO of Lehman and Morgan Stanley and Goldman and Citibank had to take a very small percentage of every mortgage-backed security... or every loan they made?