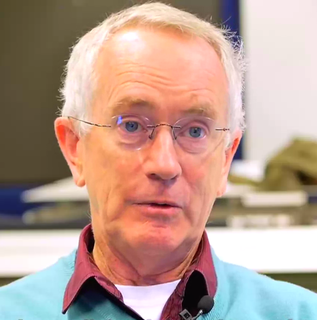

A Quote by Chuka Umunna

To be clear, aiming to reduce the national debt in the long term and running small surpluses when the economy is operating close to full capacity is what I mean when I talk about seeking to 'balance the books' - a sensible approach.

Related Quotes

If you have a sane economy, and by sane economy I mean one which is not addicted to debt, not a Ponzi economy, then the change in debt each year should contribute a minor amount to demand. Therefore, if you tried to correlate debt to the level of unemployment you would not find much of a correlation. Unfortunately that is not the economy we live in.

We have to have an aggressive, long-term plan to tackle our nation’s debt, but attempting to balance the budget on the backs of veterans who have risked life and limb in service of our country is unacceptable. I believe we can and should work together to find reasonable and common-sense cuts that will reduce our debt, but as a generation of warriors returns from two wars, our most solemn responsibility is to make sure they have the care and benefits they have earned.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.