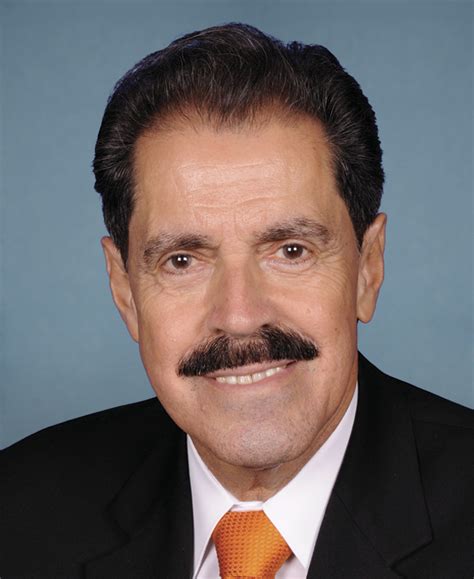

A Quote by Clementa C. Pinckney

This is Robin Hood in reverse. These tax cap proposals favor those with the most expensive properties. We are spreading the taxes to those with some of the least expensive property.

Related Quotes

The best taxes are such as are levied upon consumptions, especially those of luxury; because such taxes are least felt by the people. They seem, in some measure, voluntary; since a man may choose how far he will use the commodity: They naturally produce sobriety and frugality, if judiciously imposed: And being confounded with the natural price of the commodity, they are scarcely perceived by the consumers. Their only disadvantage is that they are expensive in the levying.

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

Eventually we'll use a CO2 tax offset by a reduction in taxes elsewhere alongside a cap-and-trade plan, but the degree of difficulty associated with a CO2 tax far exceeds that with a cap-and-trade plan. We're seeing it's hard to get a cap-and-trade plan and it's much easier to use as a basis for a global agreement than a CO2 tax.

Germany has great skill levels, great infrastructure, high-quality plant. If you go to the U.K., we're very creative, and we've got the language, but energy costs are pretty much the most expensive in the Western world; pensions are pretty expensive, and the skills are significantly below those in Germany and the U.S.

Inflation is not a Robin Hood, taking from the rich to give to the poor. Rather, it deals most cruelly with those who can least protect themselves. It strikes hardest those millions of our citizens whose incomes do not quickly rise with the cost of living. When prices soar, the pensioner and the widow see their security undermined, the man of thrift sees his savings melt away; the white collar worker, the minister, and the teacher see their standards of living dragged down.

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.