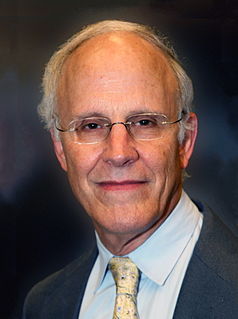

A Quote by Clive Granger

A potentially useful property of forecasts based on cointegration is that when extended some way ahead, the forecasts of the two series will form a constant ratio, as is expected by some asymptotic economic theory.

Related Quotes

Experts kill me. Economic experts, that is. Corporations, foundations, publications and governments pay them by the bucketful, and they fill buckets with forecasts that change more frequently than white-collar, workers do shirts. What Lies Ahead is the usual title. What Lies would often be more appropriate. If women's hemlines changed as rapidly as an economist's forecasts, the fashion people and the textile industry would be more profitable than any other. In fact, if all the country's economists were laid end to end, they still wouldn't reach a conclusion.

Some of what these pamphlets [of astrological forecasts] say will turn out to be true, but most of it time and experience will expose as empty and worthless. The latter part will be forgotten literally: written on the winds while the former will be carefully entered in people's memories, as is usual with the crowd.

Library of the Works of Ludwig von Mises”. Here is an article he wrote in 1951, some two years after his magnum opus Human Action appeared, where is lays out his case in a more popular form. The money sentences are “Economic theory has demonstrated in an irrefutable way that a prosperity created by an expansionist monetary and credit policy is illusory and must end in a slump, an economic crisis. It has happened again and again in the past, and it will happen in the future, too.

Unlike physics, for example, such parts of the bare bones of economic theory as are expressible in mathematical form are extremely easy compared with the economic interpretation of the complex and incompletely known facts of experience, and lead one a very little way towards establishing useful results.

We will continue to ignore political and economic forecasts, which are an expensive distraction for many investors and

businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%.