A Quote by Clive Granger

I work with the macro economy, which involves the major variables that measure the health of the whole economy, such as total consumption, investment, income, employment, and inflation.

Related Quotes

No politician can praise unemployment or inflation, and there is no way of combining high employment with stable prices that does not involve some control of income and prices. Otherwise the struggle for more consumption and more income to sustain it-a struggle that modern corporations, modern unions and modern democracy all facilitate and encourage-will drive up prices. Only heavy unemployment will then temper this upward thrust. Not many wish to confront the truth that the modern economy gives a choice only between inflation, unemployment, or controls.

The illusion that consumption - and its correlative, income - is desirable probably stems from too great preoccupation with what Knight calls "one-use goods," such as food and fuel, where the utilization and consumption of the good are tightly bound together in a single act or event. ... any economy in the consumption of fuel that enables us to maintain warmth or to generate power with lessened consumption again leaves us better off. ... there is no great value in consumption itself.

The impact of QE on generating more lending by Wall Street to Main Street and in generating more employment and increasing overall investment in the economy is quite modest. QE probably limited the initial collapse of the economy in 2008, and likely had a very small positive impact on economic growth, but its broader impact on jobs and growth in the economy seems not very big.

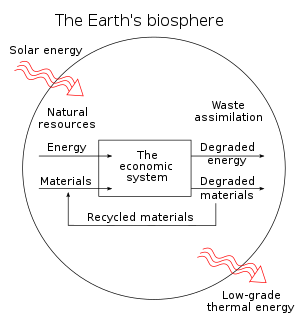

... placing economic activity in the context of the whole earth requires attention to the question of scale. Bigger is obviously not better, so the optimum scale of human economy in relation to the total economy becomes basically a question of sustainability. When the effects of the economy on the environment undercut the possibility of its own continuance, the scale is too large.

One thing I want to emphasize is that, like any human being, we can discuss our view of the economy and the market. Fortunately for our clients, we don't tend to operate based on the view. Our investment strategy is to invest bottom up, one stock at a time, based on price compared to value. And while we may have a macro view that things aren't very good right now - which in fact we feel very strongly we will put money to work regardless of that macro view if we find bargains. So tomorrow, if we found half a dozen bargains, we would invest all our cash.