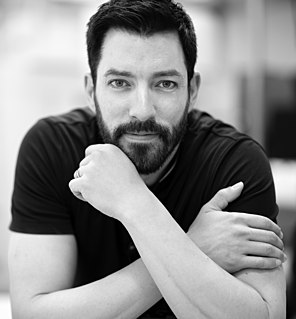

A Quote by Corey Lewandowski

Your tax returns on a yearly basis don't tell you what you're worth. What they show is what your income is.

Related Quotes

You may have heard that Donald Trum has long refused to release his tax returns, the way every other nominee for president has done for decades. You can look at 40 years of my tax returns. I think we need a law that says, if you become the nominee of the major parties, you have to release your tax returns.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.

Your income is a direct reward for the quality and quantity of the services you render to your world. Whatever field you are in, if you want to double your income, you simply have to double the quality and quantity of what you do for that income. Or you have to change activities and occupations so that what you are doing is worth twice as much.

Missing paperwork is one of the top reasons for delays during the mortgage process. I suggest following the two-by-two system: two most recent pay stubs, tax returns, W-2s from your employer, and bank statements from all of your savings and checking accounts. Be sure to remain clear and transparent, provide evidence of all forms of income.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.