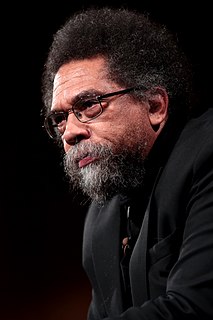

A Quote by Cornel West

Market moralities and mentalities-- fueled by economic imperatives to make a profit at nearly any cost-- yield unprecedented levels of loneliness, isolation, and sadness. And our public life lies in shambles, shot through with icy cynicism and paralyzing pessimism. To put it bluntly, beneath the record-breaking stock markets on Wall Street and bipartisan budget-balancing deals in the White House lurk ominous clouds of despair across this nation.

Quote Topics

Across

Any

Balancing

Beneath

Bipartisan

Breaking

Budget

Clouds

Cost

Cynicism

Deals

Despair

Economic

Fueled

House

Icy

Imperatives

Isolation

Levels

Lies

Life

Loneliness

Make

Market

Markets

Nation

Nearly

Ominous

Our

Pessimism

Profit

Public

Public Life

Put

Record

Sadness

Shambles

Shot

Stock

Stock Market

Street

Through

Unprecedented

Wall

Wall Street

White

White House

Yield

Related Quotes

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

First of all, the Social Security money belongs to Main Street, not to Wall Street. It needs to be said very clearly here that privatization is off the table... Social Security, as a matter of fact, is a better investment now than the stock market. There's a higher return. There's guaranteed cost-of-living increases. Privatization you have to worry about the value of your account.

A tension has always existed between the capitalist imperative to maximize efficiency at any cost and the moral imperatives of culture, which historically have served as a counterweight to the moral blindness of the market. This is another example of the cultural contradictions of capitalism - the tendency over time for the economic impulse to erode the moral underpinnings of society. Mercy toward the animals in our care is one such casualty.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.