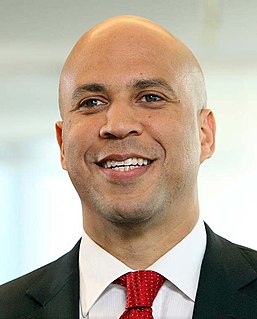

A Quote by Cory Booker

I sit in the Senate, and see what Republicans are often advocating, it's those kind of tax loopholes for the richest of the rich or, frankly, for corporations and giving incentives for them to move jobs and opportunity overseas.

Related Quotes

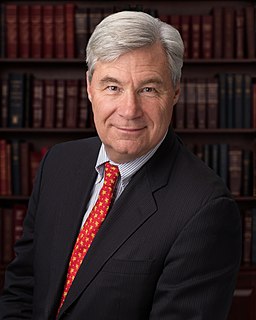

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

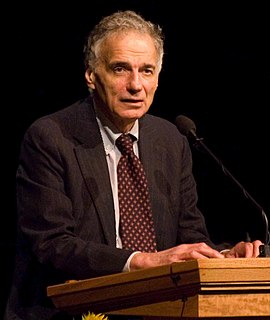

In the meantime the big corporations are fleeing America for tax havens and places like Ireland, Luxembourg and the Grand Cayman Islands; the rich are finding more tax loopholes to expect; so when are the people going to basically roll up their sleeves and say, we've had enough, we're going to recapture Congress.

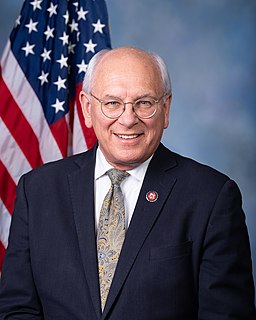

What the Trump tax plan is a plan to give tiny little tax cuts to most Americans, raise taxes on perhaps one in five families and shower benefits on people who earn millions of dollars a year. And this fits with a fundamental principle the Republicans have been pursuing for a long time. The rich aren't investing and creating jobs, because they don't have nearly enough money, and so we need to get them money. And the way the Republicans want to get it to them is tax cuts first, and then to take away help for children, the disabled, the elderly and the poor.