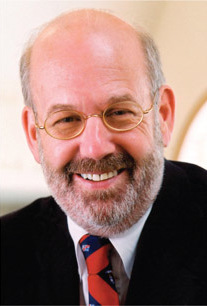

A Quote by Costa-Gavras

In the U.S. more than any other place, the banking system is insane. Millions of Americans lost their houses. Because of what? Because of the banking system. This American banking system is also coming to Europe. We can say today that the banks and high financiers run the world.

Related Quotes

Italy spills over to everything. Italy is a huge banking system. It has been the major banking system in Eastern Europe. It's worked with Austria's banking system. There's all sorts of interplays there. So it's not the PIIGS one should worry about. Germany hasn't even begun falling yet. And when Germany falls, and it will, that's when the panic begins to set in.

Repeal the entire Banking Act of 1933, and Austrian School economists will cheer, especially if the current system were replaced by a 100%-reserve competitive banking with no central bank. That banking reform would give us a sound money system, meaning no more business cycle, bailouts, or inflation.

I've got to say our banking system is a safe and a sound one. And since the days when we've had federal deposit insurance in place, we haven't had a depositor who's got less than $100,000 in an account lose a penny. So the American people can be very, very confident about their accounts in our banking system.

Innovation has stalled in the banking industry. While the rest of the world is in the digital age, banking remains stagnant. We are here to change this and bring banking to the 21st century. We will ensure our customers feel involved in the progress of this bank and are offering them a truly enjoyable banking experience – different from anything they have experienced before.

Having examined the nature of fractional reserve and of central banking, and having seen how the questionable blessings of Central Banking were fastened upon America, it is time to see precisely how the Fed, as presently constituted, carries out its systemic inflation and its control of the American monetary system.